The Cambridge life sciences community has the scientific ambition, original thinking, collaborative network and talent to play a leading role in the Government’s new life sciences sector plan and its ambition to drive health innovation in the NHS ten-year plan. Together we will help to make the UK the leading life sciences economy in Europe; and by 2035, the third most important life sciences economy globally.

The sector plan aligns with our ambitions and strengths:

- The secret to Cambridge’s long history of success is collaboration, coupled with a common goal to share health and economic benefits and improving lives at speed within the region, the UK and the world.

- We want to help to grow the local and national economy, create skilled jobs across our community, invent medicines and technical devices that are readily adopted into our health and care system, and allow more people to be monitored near or in their own homes.

- The NHS isn’t a problem to be solved. By working with industry and academia it can be a key part of the solution to modernising healthcare and the economy.

- We look forward to hosting the new national Health Data Research Service (HDRS), establishing and /or being part of the translation network and a Regional Health

Innovation Zone.

This document sets out some of the activities already in motion, outlined in the Life Science Strategy for the Cambridge Cluster, alongside our plans as a whole ecosystem to deliver on the recommendations in the Industrial Strategy life science sector strategy and NHS ten-year plan, with accompanying asks and offers of UK Government and other stakeholders.

Our ask of stakeholders (including DHSC / DBT / OLS):

Pillar 1 – Enabling world class R&D

ACTION 2a: Pre-clinical translational infrastructure

Engagement and Collaboration: In collaboration with government, academic, clinical and industry organisations in the Cambridge cluster become trusted partners to support, shape and define specific translational challenges. Building on existing Cambridge assets and a strong relationship with the MRC, Cambridge can be a testbed for bringing together research, patients, trials, data and bio-sample assets across the ecosystem to deliver a centre which can validate and standardise new human-relevant models. Specifically, but not limited to: Oncology, Cardiometabolic & immunology themes.

ACTION 3 & ACTION 4: Speed up set-up times for commercial interventional clinical trials and significantly expand commercial clinical trials capacity

Engagement and Collaboration: Conversations with the MHRA, about how we can be a test bed for novel clinical trial approaches, have already started in Cambridge. Looking to capitalise on the capability of adopting AI in clinical trial design and patient recruitment, we ask that when companies approach NHSE or OLS looking to conduct or develop new studies, Cambridge would be keen to mobilise our researchers, patients and facilities to first design the novel approach and then to run the research.

ACTION 6 & ACTION 12: Enhance the offer to BioTech and MedTech SMEs to develop and evaluate high value innovation for maximum growth alongside improving health outcomes and building a strong foundation for future research

Funding, Engagement and Collaboration: It is important that funding is made available for local facilitation provision, in areas of high intensity innovation, to provide support for the application processes and communication, which need to be continually sign-posted and managed efficiently. The Cambridge cluster is well suited to receive continued support from government bodies to enable the quicker evaluation and testing of new, high value innovations that are created in the high-intensity innovative ecosystem. To support economic growth further, following the government’s recent allocation of Regional Investment Zones, Cambridgeshire and Peterborough should also be considered as an investment zone to attract more BioTEch and MedTEch companies into the UK to be near a thriving innovation ecosystem.

ACTION 7, ACTION 8 and ACTION 9. National Health Data Research Service. Speed up access to health data for research and enhance UK’s consented health research datasets and cutting-edge infrastructure

Funding: The Secure Data Environment Programme would have benefited from longer term funding certainty. The Health Data Research Service needs to rapidly identify how it wants the Secure Data Environment programme to evolve and provide a longer-term planning framework to allow momentum to be maintained.

Engagement and Collaboration: We ask for backing to engage and communicate patient and public benefit for use of health and care data for R&D. While national governance changes would be helpful and could be done in a way that enhances both use and protection of data, significant focus needs to be given to public and professional engagement.

Pillar 2 – Making the UK an Outstanding Place in which to Start, Grow, Scale and Invest

ACTION 13 and ACTION 14. Life Sciences Industrial Strategy Growth Capital to support investment and growth, and crowd-in additional global investment into UK life sciences

Engagement and Collaboration: We ask government bodies and the British Business Bank (BBB) to work with the Cambridge cluster to drive engagement with investors. Bringing them to Cambridge, and with our support, to showcase what opportunities the city and the wider cluster have to offer. A visit in 2023, where DBT brought multiple US investors to Cambridge, was hugely successful, and we would propose this approach to become a regular arrangement.

ACTION 16, ACTION 17 and ACTION 18. Build a highly skilled Life Sciences workforce with existing and new programmes to improve sector-specific skills. Promote UK strengths to attract international life sciences talent

Funding, Engagement and Collaboration: Dedicated seed funding and government championing is needed to accelerate business development and build momentum for the Talent/Opportunities Hub. Showcasing the success of schemes outlined in the proposal (e.g flexi-apprenticeship scheme and multi-specialist hub), increased capacity could secure additional sources of funding through grants and business support. A full, comprehensive multifaceted Hub, for the life sciences and technology sectors in the Cambridgeshire and Peterborough Combined Authority area, is estimated to cost approximately £8mn over 6 years, after which it should be self-sustaining with sponsorship and participant funding.

ACTION 22. Major strategic partnerships

Engagement and Collaboration: As the UK Government bodies engage with potential UK strategic partners, Cambridge would welcome conversations to identify where Cambridge can initiate, support or land new strategic partners. Cambridge is open for business. We would like the government to feel able to approach Cambridge University Health Partners, who actively support the whole Cambridge cluster, to help brainstorm and shape strategic partnerships. We can support by highlighting existing collaborations and provide access to researchers, clinicians or institutions, which could form part of new strategic partnerships.

ACTION 23. Support high-potential UK companies to successfully scale, invest and remain in the UK

Engagement and Collaboration: The Cambridge cluster would like to offer the OLS support in identifying the scaling companies and establishing a set of smart criteria for their identification. In addition, we would like to support further, by working closely with the CPCA, in identifying the real needs of companies in the region to help OLS to frame its ‘support service’.

Funding: To continue the momentum of the Multi-Specialist Hub, that supports scaling companies by matching to fractional talent, resource for a project manager and setup activities is needed, covering:

- Legal fees for incorporation and drafting governance documents

- Basic operational setup and administrative costs

Seed funding (£40-60K) would provide a proof of concept for 18 months after which it could be self-sufficient. If successful, the model could be expanded across the Ox-Cam growth corridor and the UK more broadly.

Pillar 3 – Driving Health Innovation and NHS Reform

ACTION 31. Strengthen innovation metrics for medicines and medtech through an updated and expanded innovation scorecard

Engagement and Collaboration: Cambridge NHS trusts are keen to work with government to devise the Key Performance Indicators for the NHS Innovation Scorecard and be lead adoption sites. We can then build on the initial metrics which we have already adopted across our NHS providers for both medical technologies and medicines. Cambridge would include a number of industry partnerships established, recognising that the NHS will be a key delivery vehicle for Government ambitions in support of Actions 22 and 23.

Funding: Whilst we support the implementation of innovation metrics for providers, NHS organisations will still need support and investment to generate the capacity and capabilities to land innovations and to work with industry. The development of longer-term revenue streams for this type of work would be a critical enabler.

ACTION 33. Establish Regional Health Innovation Zones for large scale development and implementation of innovation, for scale up across the health and care system

Funding, Engagement and Collaboration: We ask that the East of England be considered a trailblazer for the proposed Regional Innovation Zones. Indeed, Cambridgeshire and Peterborough presents a compelling case with a Mayoral Combined Authority embedded at the heart of Europe’s leading life sciences cluster.

Other asks relating to innovation include:

- Champion the new Cancer and Children’s research hospitals to support patient health and Innovation for the Eastern Region and progress the business case for the rebuild of the acute facility in collaboration with MHCLG as they look to significantly grow the population of the region.

- Make the testing and adoption of ‘innovation’ part of the core business of the NHS:

- Support NHS organisations to invest in the capacity to land innovations.

- Align funding priorities across different organisations, e.g. NIHR/BRC and Innovate UK, to match the NHS’s key health priorities.

- Mobilise geographies to focus on working across industry, academia and NHS on core priorities.

- Expand the Key Performance Indicators for the NHS to measure and set targets for the number of new innovations trialled and adopted. Reward success in these areas.

Investing in research-intensive, innovative hospitals will finally make the NHS a genuine testbed for innovation, supporting the delivery of the NHS 10-year health plan: powering transformation – Innovation to drive healthcare reform.

Pillar 1 – Enabling world class R&D

The Cambridge cluster welcomes the news of continued government investment into the discovery sciences. Funding for research is heavily reliant on charitable and government funding. Our discovery engine is vital to power long-term growth, and to ensure that the UK can continue to compete internationally in high value but fast-moving areas such as advanced therapies, machine learning, brain mapping and genomics.

In Cambridge, successful blue skies science is exemplified by the work being carried out at world leading academic research institutions @Anglia Ruskin University, @Babraham Institute, @Laboratory of Molecular Biology, @University of Cambridge, @Wellcome Sanger Institute and @NHS hospitals. These institutions already share thousands of research collaborations across the UK and the world. In addition, the region supports the formation and growth of early-stage life science ventures with laboratory facilities and research and innovation activities, at the Babraham Research Campus, Cambridge Biomedical Campus, Cambridge Science Park and Wellcome Genome Campus for example, with wider engagement with a variety of science parks and business locations. @AstraZeneca chose to build its global R&D headquarters on the @CBC – which is already the largest biomedical campus in Europe – so it can tap into our globally unique, research-rich environment.

ACTION 2a: The Government will establish pre-clinical translational infrastructure to drive development of pre-clinical models as an alternative to animals and will develop up to three fully integrated translational networks in key areas of health research.

The Cambridge cluster welcomes the commitment of at least £30 million of government funding to join up existing infrastructure and expertise to drive the delivery of translational research, accelerate the development of new medicines and medical technologies, and support the generation of data for regulatory submission.

Existing Cambridge strengths and initiatives the UK can build on:

Accelerating the development of new medicines and medical technologies requires deep understanding of the underlying mechanisms of disease, ageing and the development of new human-relevant models and translational approaches. NHS partnership will allow access to both high quality research data sets and routinely collected healthcare data and a mission driven approach to academic and industry collaboration.

I. Deep understanding of the underlying mechanisms of disease:

Bringing together the universities, research institutes and NHS Trusts in Cambridge, the NIHR Cambridge Biomedical Research Centre undertakes world-class experimental medicine and early translational research, investigating early pathways leading to diseases of high health and economic burden, and has substantial first-in-human clinical trials capabilities.

For example, The Babraham Institute, located at the Babraham Research Campus, is one of many academic institutions in Cambridge that undertakes world leading research in human biology sparking the innovative advances which will improve and protect lifelong health. The Babraham Institute is dedicated to making the fundamental discoveries needed to maintain health and improve wellbeing throughout life. Another example is the School of Biological Sciences at the University of Cambridge, which plays a crucial role in the advancement of experimental medicine, through its cross-cutting, interdisciplinary research themes and investigation into early disease pathways.

Cambridge also has world-leading collaborative strengths in genomic medicine, particularly benefiting from the co-location of the Wellcome Sanger Institute, which led the sequencing of the human genome. Cambridge-rooted Solexa-Illumina’s next-generation genome sequencing technology produces 90% of all DNA/RNA sequencing data worldwide. More recently, the joint Functional Genomics Screening Laboratory was established as a joint venture between the Milner Therapeutics Institute at the University of Cambridge, the Medical Research Council and AstraZeneca to enable functional interrogation of the genome at scale.

II. Development of new human-relevant models and translational approaches:

Patient-derived induced pluripotent stem cells and organoids, combined with advanced genome engineering technology, AI and machine learning, provide excellent platforms for studying human diseases and will be critical in drug discovery and diagnostics.

The development of new human-relevant models in organoids is at the heart of the Cambridge Stem Cell Institute, a world-leading centre for stem cell research, which brings together outstanding research groups from across the University of Cambridge, to generate new diagnostic and therapeutic approaches. The Milner Therapeutics Institute, AstraZeneca and the MRC are developing novel in vitro human and patient-derived models and approaches to making these models high-throughput screening-ready for functional genomics and other endpoints.

Cambridge is home to world-class talent across disciplines, exemplified through the Cambridge Centre for AI in Medicine, and the Engineering Biology Research Hub at the University of Cambridge. Wellcome Sanger Institute researchers are pioneering the new field of generative genomics, leveraging AI tools to predict, design, and engineer biological sequences, such as DNA and proteins.

III. NHS partnership with access to both high quality research data sets and routinely collected healthcare data:

Cambridge University Hospitals leads the Eastern England Secure Data Environment, supporting secure, controlled access to de-personalised NHS patient data for research across a population of c.12 million. Further national assets include the EMBL European Bioinformatics Institute, the NIHR BioResource and the Cambridge hub of Health Data Research UK, leading on cardiology with the British Heart Foundation, all building on deeply characterised longitudinal patient cohorts. In addition, Cambridge hosts Open Targets which brings together academic and industry partners to systematically identify and prioritise drug targets.

IV. A mission driven approach to academic and industry collaboration:

Cambridge works with partners across the ecosystem to develop propositions that meet industry challenges, and societal challenges such as addressing health inequalities and better health throughout the life course, working strategically through Cambridge University Health Partners. Recent examples include Cambridge NeuroWorks, a consortium of organisations acting as an Activation Partner for the Advanced Research + Invention Agency (ARIA), focused on developing neuro-technologies. The recently announced Cambridge-GSK Translational Immunology Collaboration is a £50m investment combining University of Cambridge and GSK expertise in human immunology and immune-mediated diseases, AI and clinical development, with access to patient data and samples provided by Cambridge University Hospitals. In clinical delivery, Cambridge was the first to demonstrate the efficacy of early diagnosis through genomic sequencing in newborns, in partnership with Illumina. Additionally, one model developed within the cluster is the Milner Therapeutics Institute, which developed a unique pharma company consortium in 2015 and currently includes 10 global pharmaceutical companies and 75+ smaller life sciences companies, developing collaborations in the pre-clinical space. This model, and University of Cambridge’s Strategic Partnerships Office, act as key centres to link academics to industry partners.

What we are actively doing and planning:

The Cambridge ecosystem aspires to be a European hub for translational research networks, and to build upon its current strengths in providing facilities and capabilities to translate science into business at the science parks and campuses across the city.

In support, the University of Cambridge has just undertaken a review of its translational activity and as a result is working to raise funding for this important area, consolidate its assets, support staff to translate their ideas and partner more extensively. In tandem, our research-active hospital partners are seeking to support translation by providing streamlined secure access to data, clinicians, and patients.

The new Health Research Data Service, backed by Wellcome and located in Cambridge, is a major opportunity to unlock the full research and innovation potential of UK health data.

Building on Cambridge capacity in Engineering Biology Research, we will bring together a consortium of partners to bid for grants to develop infrastructure to increase capability and capacity that will provide academics and industry (big pharma and SME’s) with expertise and facilities progress at pace.

Two new specialist hospitals (the Cambridge Children’s Hospital and Cambridge Cancer Research Hospital) are in development and will act as exemplar translational environments. Each will bring together academic, clinical and industry partners to effectively fast-track innovation and markedly improve patient care.

Our ask of DHSC / DBT / OLS and other stakeholders:

Building on the model of the Cambridge-GSK Translational Immunology Collaboration, we are keen to define specific challenges with government and industry, bringing together research, patients, trials, data and bio-sample assets across the ecosystem. The intention would be to build on our existing assets and strong relationship with the MRC to deliver a centre which can validate and standardise new human-relevant models.

Cambridge has multiple areas of strength where a ‘zone’ could focus, and we will work closely with the Government bodies to develop themes. Three themes, in particular, could pool assets around a mechanism of disease with a clear line of impact to a known area of significant medical need. The first would focus on oncology, through the collaborative institutions including, the Cancer Research UK Cambridge Institute, the Early Cancer Institute, the Cambridge Cancer Centre and forthcoming Cancer Research Hospital. The second on cardiometabolic research, particularly through the MRC Institute for Metabolic Sciences and the Victor Phillip Dahdaleh Heart and Lung Research Institute which combines the strengths of the University of Cambridge with Royal Papworth Hospital, a world-leading cardiorespiratory specialist provider and the UK’s leading heart and lung transplant centre. The third theme would focus on immunology research, highlighting programmes including the inflammatory bowel disease (IBD) BioResource, the aforementioned GC-TIC partnership and the Cambridge Institute for Therapeutic Immunology and Infectious Disease (CITIID).

ACTION 3: The Government will cut bureaucracy and standardise contracts to reduce the set-up time for commercial interventional clinical trials to fewer than 150 days by March 2026 and ACTION 4: Significantly expand commercial clinical trials capacity via funding from the VPAG Investment Programme.

Existing Cambridge strengths and initiatives the UK can build on:

Cambridge has purpose built NIHR Clinical Research facilities (CRF), that has been delivering world-leading experimental medicine and early translational research to benefit patients and the public for over 20 years. Located on the largest Biomedical Campus in Europe, the CRF is ideally placed to collaborate with a wide variety of clinical researchers, scientists, industry and research infrastructure, to deliver a diverse range of early-phase and complex studies spanning many different clinical conditions. The Campus also hosts GSK’s only global translational and experimental facility.

The oncology teams at Cambridge University Hospitals has worked collaboratively with their counterparts at AstraZeneca to improve the set up and recruitment times for cancer studies and increase the number of patients participating in trials. That work has also fed into the ‘Just in Time’ NIHR Activation Scheme, which is being piloted in the PemOla trial led by Dr Pippa Corrie.

There is also considerable expertise in the design and set up of trials available from our MRC Biostatistics and MRC Toxicology Units and centres for AI in medicine, where work is being done on virtual patients, digital twin trials and trial arms.

In 2025, Cambridge University Health Partners (CUHP) was delighted to welcome Lord James O’Shaughnessy as the new Chair of the organisation. We look forward to supporting the recommendations of his review to increase the efficiency and number of commercial clinical trials in the Cambridge cluster and to pioneering new ways to attract industry trial partners to the UK.

What we are actively doing and planning:

We are establishing a subcommittee of the CUHP board to review performance on clinical trial metrics and the uptake of innovation. This is overseeing, sharing best practice and aligning activity across our three NHS Trusts. These actions include:

- The National Contract Value Review (NCVR) being fully embedded across all Cambridge Trusts to eliminate site-level contract negotiations. This will reduce variability and speed up the contracting process, particularly for commercial sponsors.

- Making it easier for NHS clinicians to have the time and the skills to be involved in trials whilst also growing our pool of PIs.

- Clarifying the guidance and processes for identification of patients eligible for clinical trials using internal trust mechanisms, but also the newly established capabilities of the regional Secure Data Environment.

- Streamlining the review process and making sure NHS departments (e.g. pharmacology, histopathology, genomics laboratory) have the capacity to support clinical trials.

- Work with our industry partners over the next 6 months to identify academic, NHS, industrial collaboration opportunities for the deployment of AI into clinical trials.

- Reviewing the processes in our research offices to use speed up contracting and put in place arrangements to allow third parties to be able to deal with single point of contact across different Cambridge legal entities.

We believe that there is considerable opportunity to use improved data infrastructure and emerging AI technologies to reduce the time and cost of clinical trials. Our ‘AI in health’ prospectus details some of the opportunities we see in this space and our regional SDE is putting in the capacity to support both recruitment but also real-world evidence gathering for enhanced and more extensive post market surveillance. Finally, we are thinking about how we can gather additional data into trials to assess broader outcomes e.g. economic, social and educational data, to allow impact to be more fully understood.

Our ask of DHSC / DBT / OLS and other stakeholders:

We have already started conversations with MHRA about how we can be a test bed for novel clinical trial approaches. When companies approach NHSE or OLS looking to conduct or develop new studies, we would be keen to mobilise our researchers, patients and facilities to first design the novel approach and then to run the research.

ACTION 6: Substantially enhance the NIHR offer to BioTech and MedTech SMEs to develop and evaluate high value innovation. ACTION 12: The government will update NIHR’s governance model and require the NIHR to work to a dual health and growth mandate, driving focus on activity which is growth-maximising alongside improving health outcomes, building a strong foundation for future research.

Cambridge is leading the way as one of the world’s most intensive science and technological cluster, and the most innovative city in the UK. The Cambridge cluster has a significant interest in supporting the development and evaluation of high value innovation through a new NIHR R&D Innovation Catalyst to meet the demands of the health and care system. A large proportion of the growth of this system is attributed to the CPCA’s MedTech and software as a medical device (SaMD) industry. This exceptionalism in discovery is combined with advanced materials innovation, which is a pillar of the Government’s Invest 2035 Strategy, and a key strength of this region. Cambridge is ranked within the Top 3 in Europe for ERC-Funded Materials Research. Over 135 materials spin outs and scale-ups have been established within this national discovery engine with manufacturing hotspots concentrated in South Cambridgeshire, Peterborough and the Fenland. Such a high concentration of both discovery and manufacturing assets paves the way for ample opportunity for the region to translate innovations further and faster, and to share this expertise with others across the UK.

The core ambition in this region is to provide a managed “critical path” that takes innovations from early design, through prototyping and iterative testing, into robust pre‑clinical and clinical validation, and then on to regulatory approval, adoption and export. The ability to achieve this depends on effectively embodying the triple-helix model, where academia, industry and government work together to outline and implement this path. Today, innovators encounter a patchwork of offers that they must navigate alone; the intention is to turn this into an organised journey with defined stages, clear responsibilities and predictable timescales. By doing so, the cluster aims to de‑risk MedTech and software as a medical device (SaMD) development much earlier in the process, so a larger proportion of promising ideas successfully reach patients, attract appropriate investment and scale from within the region rather than relocating overseas. A further objective is to support NHS productivity and health outcomes by prioritising technologies that address validated clinical needs, fit into real‑world workflows and can demonstrate meaningful impact on cost, capacity and quality of care. The goal is to provide a globally compelling offer to attract international investment to the UK, leveraging the strengths of our NHS to test and trial new products and services.

We are excited by the prospect of R&D funding provision through the translational phases of research when key milestones are met, providing the wraparound support that will connect innovators to testbeds, venture capital (VC) funds, regulators, procurement processes, and support for commercialisation. This should also provide support for clinical-stage scale-ups. In addition, insuring we have access to the best talent, from wherever it hails worldwide, will also ensure that SMEs have the capacity to be successful and to grow.

Existing Cambridge strengths and initiatives the UK can build on:

In 2022, NIHR awarded £86.2m to the Cambridge Biomedical Research Centre that supports translational research in areas such as cancer, dementia and cardiovascular and respiratory diseases. The strategic partnership between Cambridge University Hospitals NHS Foundation Trust and the University of Cambridge is a key vehicle for supporting, delivering and providing leadership in translational research within the NHS, both locally and nationally. Specifically, the Devices and Advanced Therapies theme, focus on developing areas of technology that will likely revolutionise NHS care, such as artificial intelligence (AI), genomic medicine and new state of the art imaging techniques.

The Cambridge BRC themes work with academics and clinicians to support innovation and create commercially viable products. Working and partnering with SMEs and large commercial companies to create trusted medical devices including algorithms and mobile apps, transforming implants and bio-interfaces for diagnosis and monitoring, generating innovative delivery platforms for advanced therapies and developing advanced cellular, stem cell and gene therapies.

What we are actively doing and planning:

The Cambridge cluster is fully committed to and already establishing national collaborations in support of the UK agenda.

To be successful and grow, SMEs in the BioTech and MedTech sectors, require a steady flow of talent and the ability to develop and upskill current employees. We are developing alternative and flexible opportunities for SME’s to be able to build their talent pipeline via a flexi-apprenticeship scheme (see Pillar 2 below). Additionally, the Cambridge cluster is recruiting a business development manager to support the technical talent pipeline in the innovation sector to allow for the growth of SME’s and demand for these essential roles.

Conversations are well underway for Cambridge to be one of the first sites in the UK to offer Fellowships in collaboration with Flagship Pioneering. These bespoke fellowships grew out of collaborative engagement with the NIHR Biomedical Research Centre senior leadership teams and demonstrate direct examples of how collaborations work to a dual health and growth mandate.

There is an abundance of facilities and opportunities for SMEs and the NHS (for example, through Health Innovation East) to collaborate and co-innovate with the Cambridge cluster. We are working to make these easier to identify and navigate through communication and signposting. The three NHS Trusts in the Cambridge ecosystem are proactively supporting and developing Innovation Landing Zones (see action below), which make it easier for BioTech and MedTech SMEs to develop, test and evaluate high value innovation in real world populations. These functions will also be able to support and signpost SMEs to venture capital funds, regulators, procurement processes and support for commercialisation.

Additionally, there is the development of The Institute for Biomedical Innovation (IBI), a new major investment by the University of Cambridge. Based in the Department of Engineering, the IBI aims to turn early-stage medical technologies into safe, sustainable, clinically ready devices. It will combine a state-of-the-art prototyping facility equipped for microfabrication, device assembly, and biological testing, with an innovation support programme that guides researchers and companies through sustainability requirements, quality management, clinical trial design, and regulatory approval. Once operational, it will be open to all, and will provide shared laboratories, expert technical staff, and training to speed up the journey from laboratory ideas to real-world healthcare solutions, while also supporting more sustainable manufacturing and better preparedness for future health emergencies.

Our ask of DHSC / DBT / OLS and other stakeholders:

The Cambridge cluster is best suited to receive continued support from government bodies to enable the quicker evaluation and testing of new, high value innovations.

It is important that funding is made available for local facilitation provision, in areas of high intensity innovation, to provide support for the application processes and communication, which need to be continually sign-posted and managed efficiently.

Cambridgeshire and Peterborough should be considered as a regional investment zone to attract more BioTEch and MedTEch companies into the UK to be near an already thriving innovation ecosystem.

ACTION 7. Establish the National Health Data Research Service. England and > UK wide collaboration. ACTION 8. Government will use a combination of policy and legislative change to speed up access to health data for research and other secondary purposes, streamlining governance processes to maintain core safeguards while operating in a more efficient way. ACTION 9. Expand and enhance the UK’s consented health research datasets and develop the cutting-edge infrastructure needed to deliver a comprehensive genomics ecosystem, maximising patient benefit, with the potential for genomics to contribute to half of all healthcare interventions by 2035 – Our Future Health/ UK BioBank/ Genomics England/ NHS Genomic Medicine Service. UK/England

Existing Cambridge strengths and initiatives the UK can build on:

The Cambridge cluster welcomes the Government’s dedication to using health data for research. We are particularly excited to have the National Health Data Service located in the locality and look forward to supporting the Service to collaborate with, build on and utilise the extensive Cambridge expertise in this space. The Wellcome Sanger Institute and the co-located European Bioinformatics Institute have huge expertise at making large data sets accessible and usable, Open Targets being a prime example. The NIHR BioResource, which was the first bioresource to start using genomic data and remains the UK’s largest disease focused cohort of phenotyped and recallable patients, understands the challenges of maintaining patient trust and supporting access to patients. Cambridge University Hospitals (Addenbrooke’s) was the first hospital to install Epic (electronic health record database) and has ten years of longitudinal data on its patients. CPFT has a research database of anonymised clinical records, used for research into dementia and other mental health conditions. There are also a number of nationally significant research cohorts based in our region, including the Fenland cohort. The HDRUK Data centre in Cambridge has expertise in the application of research onto health care data sets and how to transform those into tools and policies, with Angela Wood leading on the national British Heart Foundation Cardiovascular data set. The Eastern England Secure Data Environment – which will merge into HDRS – has already benefited from and built upon insights from these groups.

Cambridge researchers and clinicians led the way in the newborn genomes programme, which is a Genomics England led project in partnership with the NHS, by being one of the first NHS Trusts to participate and recruit participants. This project is based upon research and experience of sequencing the complete genomes of babies and their families to have better outcomes for the children. There are other similar programmes working to identify the value of genomic sequencing across disease areas such as brain tumours and childhood leukaemia, and we look forward to translating these rapidly to inform national policy.

Cambridge is excited to hear that the government is dedicated to changing policies and legislation to support using health data for research. Accessing primary care data for research purposes is currently a significant challenge, as GPs are the data controllers for the information they hold on their patients. They are responsible for the data and for ensuring compliance with legal requirements regarding its use. As a result, to access data for research within the NHS Secure Data Environment in the Eastern England arrangements must be made with more than 600 data controllers, each of whom must ensure that the data usage complies with the law. One potential solution is to designate Integrated Care Boards (ICBs), which are beginning to collect primary care data for direct care or service planning, as the data controllers for this information. Whilst other approaches may exist, longitudinal primary care data remains one of the UK’s unique data sets, yet it is currently extremely difficult to access.

What we are actively doing and planning:

Moving towards a model of data access (rather than ‘sharing’) for research, our Secure Data Environment programme has already delivered a fully Standard Architecture for Trusted Research Environments (SATRE) compliant research environment utilising the latest AWS Research Engineering Studio tooling. It is also now looking to demonstrate by the end of the year how health care data in hospitals can be left in place and queried remotely and then brought into a research environment on an as-needed basis to reduce the need for large data lakes. In addition to making routinely collected NHS data available, the environment is also a place where researchers have started to place other healthcare data such as longitudinal research cohorts, to facilitate collaboration more easily. The East Midlands region including Nottingham and Leicester NHS trust’s have been attracted by this model and recently formally merged with the East of England. In preparation for the national HDRS we are actively looking at how our SDE programme works with others with complementary assets, such as Thames Valley, to provide a joined-up function across the supercluster region.

Due to our long history in genomics, there is significant Cambridge expertise in the handling of genomic data. On the academic side, within Cambridge University and funded by the NIHR Cambridge BRC, a cloud-based platform has already been developed in collaboration with Lifebit, to make it easy for researchers to process genomic data with standardised bioinformatics pipelines. We are planning to use experience from this and other health informatics work to improve the processing and use of data for service planning and research from the NHS East Genomic Laboratory Hub and Genomic Medicine Service. We are co-ordinating work across all the SDE on this topic to make sure that we have a nationally acceptable approach.

Finally, we are identifying how Cambridge University compute resources, such as high-performance secure research compute platform and the DAWN supercomputer, can potentially be utilised as part of the Secure Data Environment (SDE) and eventually the Health Data Research Service, to handle data requiring capabilities where cloud setups are not best suited.

Our ask of DHSC / DBT / OLS and other stakeholders:

There is a critical need to ensure patient and public benefit is a pre-requisite for any use of health and care data for R&D. We know that people are generally supportive of the use of their health data for research, and this support grows with understanding about how data can be shared or accessed safely and the benefits this will bring.

The SDE programme has taken the ground-up approach of securing support from patients, the public, and NHS staff by highlighting how data are used for the public good. This has increased trust and means that we now have the best possible support to build a national programme with local relevance.

Accessing primary care data at scale remains a challenge because of the devolved data controllership model and individual legal accountability of each provider organisation. It may be that changes to national governance models are required to facilitate this access – but this should be approached with caution. While changes would be helpful and could be done in a way that enhances both use and protection of data, significant focus needs to be given to public and professional engagement.

Our talented and experienced people are excited about offering their time and energy to help to shape the new National Health Data Research Service, which will be based at @WellcomeGenomeCampus.

Pillar 2 – Making the UK an Outstanding Place in which to Start, Grow, Scale and Invest

Cambridge has produced 26, billion-dollar ‘Unicorn’, businesses and counting. The Cambridge cluster has a handful of leading accelerator programmes and incubator facilities for small companies – Accelerate@Babraham and Live Labs facility; Founders@University of Cambridge; Frame Shift Bio-incubator@milnertheraputics. Institute. Cambridge is also home to several centres that link cross-sector academic ideas with industry mentorship @maxwell centre, @Milner Therapeutics Institute and @Cambridge Cancer Centre. Apollo Therapeutics, founded by the University of Cambridge to translate university discoveries into new drugs, has attracted almost $500m in funding to date and is headquartered in Cambridge. The addition of ARIA to the UK funding landscape will encourage moonshot science that may lead to the next scientific revolutions and ensure that the UK is further able to create wealth and health.

ACTION 13. Life Sciences sector will benefit as the British Business Bank (BBB) commits an additional £4 billion of Industrial Strategy Growth Capital to support investment and growth in the Government’s Industrial Strategy. ACTION 14. Crowd-in additional global investment into UK Life Sciences by publishing the BBB’s VC investment return data. UK

The Cambridge ecosystem welcomes the Government’s dedication to increasing investment into UK Life Sciences. CUHP’s Executive Director, Kristin-Anne Rutter, was recruited to sit on and advise the Office for Life Science “access to finance subcommittee”.

Existing Cambridge strengths and initiatives the UK can build upon:

Cambridge is often heralded as the ‘unicorn capital’ of Europe, contributing to economic growth and productivity in health and life sciences. However, access to finance undermines our commercial activity in this sector. This is particularly relevant at the phase of cross-over investment and in facilitating the expansion and consolidation of growing companies.

Apollo Therapeutics conducts translational research on breakthroughs made by University researchers and has invested over $65m to date directly on programmes originated at the University of Cambridge, with two University of Cambridge programmes either in or about to enter clinical development.

The city has venture capital (VC) firms embedded into the ecosystem: Cambridge Innovation Capital, IQ Capital Partners, Amadeus Capital Partners. Cambridge startups and scaleups raised an impressive $2.3 billion in 2024, the second-best year on record and almost double 2023’s $1.2 billion. These VC firms are well placed to invest and co-invest in Cambridge companies, but they only play a minority role in the capital requirements of the cluster, and more is needed to support company growth and fully capitalise on commercialisation of the region’s innovation.

What we are actively doing and planning:

To attract additional investment for Cambridge companies, CUHP has employed an Investor Engagement Manager to support the Cambridge VC firms and proactively seek and engage external investors, offering a concierge type service to showcase the whole Cambridge innovation ecosystem. This strategy has led to successfully engaging with 120+ investors globally, facilitating 15+ tailored introductions and eight in-person visits, which were based on the preferences of the investors, proactively introducing them to startups and key academics across Cambridge.

Funded by ARIA, new innovations at Cambridge NeuroWorks are designed to fast-track brain technology ideas tackling mental health and disease into global businesses. The programme supports blue sky innovation and commercialisation of ideas.

The cluster has coordinated and facilitated investor events to highlight the city to the global venture capital funder community.

- Cambridge Wide Open Week (CWOW): Ventures Tour, proposed by the local organisation o2h is a first-of-its-kind investors showcase spanning two days. Featuring a wide range of company portfolio pitch sessions hosted by some of the most prominent venture capital firms, venture builders, incubators, accelerators, and angels.

- Showcase Cambridge during Conferences:

- London Life Sciences week (Jefferies Healthcare conference): Jefferies hold their Healthcare Conference in London annually in November.

- In 2024, CUHP coordinated a satellite event co-funded by the Babraham Research Campus, o2h, Wellcome Genome Campus and AstraZeneca to showcase 17 Cambridge companies to the institutional, private equity, and venture capital investors from around the globe, who had gathered for the conference.

- In 2025, Cambridge joined forces with Oxford to showcase 20 companies to the global investors in London for the London Life Sciences week.

- JP Morgan Conference: In January, JP Morgan hold their annual Healthcare Conference in San Francisco, USA.

- In 2025, Prashant Shah, o2h, coordinated a communication platform for Cambridge presence to connect whist in USA.

- In 2026, a Cambridge x London showcase, in collaboration with RESI (Refining Every Stage of Investment), was held, with sponsorship from Ecosystem partners (o2h, Cambridge and Peterborough Combined Authority, Cambridge University Health Partners, Wellcome Genome Campus, Cancer Research Horizons, Mischcon de Reya).

- Global visits

- Ecosystem partners are expanding their reach into cities around the world. For example, Innovate Cambridge and the University of Cambridge have planned trips to New York and Paris to facilitate collaboration and investment.

- London Life Sciences week (Jefferies Healthcare conference): Jefferies hold their Healthcare Conference in London annually in November.

Our ask of DHSC / DBT / OLS and other stakeholders:

The UK needs stronger infrastructure and better coordinated financial markets to help companies establish a long-term presence within the country, rather than seeking opportunities abroad, such as listing on NASDAQ. Access to public markets, both the main list and AIM, and robust analyst coverage are critical to retaining and scaling businesses domestically. Whilst pension reform is a critical step in the right direction, the UK remains a generation behind the US in terms of investment culture and capital availability. Until these gaps are addressed, the UK’s ability to compete on a global stage will remain limited, and our most promising growth companies will continue to be sold early (e.g. Kymab).

We ask government bodies and the BBB to work with us to drive engagement with investors, bringing them to Cambridge with our support, so we can showcase everything the city and the wider cluster has to offer. A visit in 2023, where DBT brought multiple US investors to Cambridge, was hugely successful, and this model should become a regular occurrence.

ACTION 16. Build a training and skills system that delivers a diverse and highly skilled Life Sciences workforce. ACTION 17. Maximise the use of existing programmes and deliver specific new programmes to improve sector-specific skills in identified high priority areas. England. ACTION 18. Promote UK strengths to exceptional international Life Sciences talent through the Government’s Global Talent Taskforce initiatives and ensure the visa system enables the movement of world class talent.

The Cambridge Life Sciences cluster welcomes the Government’s commitment to building the ‘Talent and Skills’ pipeline for the life sciences sector.

A key driver for relocation and retention of business is access to a vibrant and sustainable talent pipeline, and productive interactions between industry scientists, clinicians and academics. Employment in Cambridge life sciences has been growing at an average of 10% per year for the last 10 years. 1 In addition, we have an ambition to ensure that these jobs are available for the local community and training locally is a key mission statement.

Consultations have identified gaps against global benchmarks, and barriers to growth in the following areas, and these gaps are likely to apply to other life sciences clusters in the UK:

- Niche and emerging specialist skills gaps

- Pathways for talent entering the sector to have skills and access to entry-level roles

- Cross over talent who have experience working across industry, academia and business

- Experience in running global operations at scale across commercial, HR, legal, clinical trials

Existing Cambridge strengths and initiatives the UK can build upon:

Cambridge has been working collaboratively since 2020 across industry, academia, the NHS and local government to identify the gaps to attracting global talent and investment in life sciences. The work we have done can be found in the iterations of our life sciences strategy for the Cambridge cluster. 2

Anglia Ruskin University is one of the leading degree apprenticeship providers in the UK. They work with over 1,000 regional and national employers to offer a wide range of future-relevant degree level programmes that have been designed to meet the needs of today’s employers and provide exciting career development opportunities. The training provision of ARU is complemented by the world-renowned undergraduate, postgraduate and doctoral scientific education provided by the University of Cambridge, which nucleates significant talent retention in the Cambridge life-sciences ecosystem.

Cambridge excels at industry-funded PhD studentships with students located at a variety of academic locations in addition to the two Universities. This includes the MRC Laboratory of Molecular Biology, The Babraham Institute and the Wellcome Sanger Institute, which across the cluster to train the researchers and entrepreneurs of tomorrow, and Fellowships for clinicians to provide training and experience in drug development. These placements are in partnership with the University of Cambridge and the NHS Trusts. AstraZeneca alone has funded over 100 PhD students over 20 years.

The Cambridge region is fortunate to have “Form the Future”, a school outreach organisation, that helps young people find their route through education into employment and provides employers access to future talent. Further examples include The Babraham Institute which also has a long-standing commitment to engage schools locally, nationally and internationally providing a range of opportunities for students and teachers, from visits to the Institute’s world-class laboratories and scientific facilities to researcher-led talks and hands-on activities. The Babraham Institute also works to raise awareness of career opportunities in the life sciences, participating in careers events and offering work experience placements and teacher training placements throughout the year. Cambridge Judge Business School is deeply engaged in many aspects of healthcare research and policy, for example through its Centre for Health Leadership & Enterprise and is major supporter of entrepreneurship through multiple initiatives and programmes.

ARU, Cambridge Regional College and West Suffolk College have developed, and continue to develop and expand, new courses for the talent demand highlighted by employers during the initial consultation in the region. For example, ARU has developed a new ‘Laboratory Scientist’ degree apprenticeship, with an early participant in the programme now placed at the MRC Laboratory of Molecular Biology. More recently, West Suffolk College have initiated a partnership with ARU to host their Level 3 Lab Technician course at ARU’s East Road Campus, which will provide greater access for apprentices based in Cambridge.

What we are actively doing and planning:

In Cambridge, we are proposing a long-term, collaborative and multi-faceted solution to the talent and skills gaps in the life sciences and technology sectors, and this has been discussed in detail with the South of England lead based within Skills England. The Talent/Opportunities Hub would act as an intelligence broker and analyse employment data to identify the skills gaps that are holding organisations back. Rather than simply observing trends, the Hub will work collaboratively with local partners, the Hub would then work closely with local partners to design the outreach programmes, training schemes and educational courses that will provide a pipeline of talent to fill those gaps. Working closely with local partners and appropriate providers will be critical to success. With great work already being done in this area by the Cambridge and Peterborough Combined Authority, the City Council, the Cambridge Regional College and others, we want to join forces to complement and boost their work, as well as adding our own schemes in skills areas they are not currently covering.

The Oxford-Cambridge Arc Universities Group (AUG) – part of the Supercluster Board – brings together higher education institutions, industry leaders, training providers, and government bodies. The talent and skills initiatives currently being led and facilitated by Cambridge University Health Partners (CUHP), has fed into the development of a regional ‘Skills and Talent Strategy’ to help unlock the full potential of the region.

Current initiatives:

- Technical talent: Nationally, there is a technician shortage across all sectors, due to a talent pipeline issue. This has also been observed in Cambridge. Generally, there are not enough people training to enter the field, whilst experienced workers are ageing out, and the economy’s demand for skilled hands-on work is soaring. This issue is due to become intensified over the next few years as both recruitment and retention become even more challenging.

- Cambridge has recently secured funding from the Gatsby Foundation to support the engagement with employers and local/regional education providers, to increase the numbers of T-level placements and technician apprenticeships (at Levels 3,4,5) across the Cambridge cluster.

- To offer the range of apprenticeship training provision for technical skills, Cambridge University Health Partners is working with Anglia Ruskin University and West Suffolk College to establish a level 3 Laboratory Technician apprenticeship in the Cambridge area. This would be hosted by Anglia Ruskin University (who generally provide level 6 provision), and delivered by WSC, a well-established provider of this level 3 standard. The Milner Therapeutics Institute supports mentoring and entrepreneurship training for academics via the BioSpark programme.

- Flexi-Apprenticeship Scheme: Cambridge University Health Partners has explored the feasibility of a flexi-apprenticeship scheme for the life sciences sector, particularly to support small and medium-sized enterprises (SMEs), that can lack the capacity for long-term employment commitments but require the capacity in expertise to grow. SMEs may not be in a position to commit to the whole span of an apprentice’s training period, due to difficulties forecasting budgets over a longer period. We have chosen to work with TrAC, due to their proven track record in delivering high-quality, employer-responsive apprenticeship solutions. We believe that there is strong appetite within the Cambridge life sciences community for innovative workforce solutions, and TrAC’s approach is well-suited to meet this demand which aligns with Cambridge University Health Partners’ (CUHP) strategic goals around talent development and inclusion. CUHP is currently running a pilot scheme at the Babraham Research Campus (that is home to over 60 companies), but with plans to expand to the wider Cambridge cluster imminently.

Business and operational management and commercial skills: Whilst Cambridge has produced 26 billion-dollar companies, there is still the sense that companies are not growing to their full potential before being acquired or get the chance to become independently sustainable This is partly an access to capital problem, but it is also a talent challenge. The Cambridge ecosystem has an abundance of mentorship for the earlier stages of growth (for example Cambridge Enterprise programmes, The Milner Therapeutics Institute BioSpark programme). However, experienced business mentors and access to relevant and specialised fractional support for scaling companies are in short supply and these are especially critical as companies scale and move to commercial mode. To support the accessibility of talent to support growth, we hope to establish a collaborative Multi-Specialist Hub – Fractional expertise for growth (see ACTION 23) and to promote ACTION 18 and the Government’s Global Talent Taskforce initiatives.

Our ask of DHSC / DBT / OLS and other stakeholders:

Ideally, some initial seed funding is needed to provide dedicated resource to the Talent/Opportunities Hub, this would accelerate the project development and build momentum. By showcasing the success of schemes listed above, in the technology and life sciences sectors, we would have the capacity to seek additional sources of funding through grants and business support. To provide a full, comprehensive multifaceted Talent/Opportunities Accelerator Hub for the life sciences and technology sectors in the Cambridgeshire and Peterborough Combined Authority area, it is estimated that we would need approximately £8mn over 6 years, after which it will be self-sustaining with sponsorship and participant funding.

Impact: This is the long-term solution to a problem that is thwarting life sciences growth across the Cambridge region, a failure to access to talent. The Hub aims to enable 2,000 new apprentices and triple the number of jobs generated by the life sciences and healthcare sector over the next decade.

ACTION 22. Land at least one major strategic partnership per year over the spending review period

The Cambridge ecosystem welcomes the Government’s ambition to establish new strategic partnerships, and we would like to offer help to achieve this.

Existing Cambridge strengths and initiatives the UK can build on:

Cambridge has played a role in both attracting and developing strategic partnerships for the UK. In recent years this has included:

- Cambridge was chosen as the location for AstraZeneca’s state-of-the-art global R&D facility located in the heart of the Cambridge Biomedical Campus, with continued investment for additional facilities confirmed.

- Cambridge has been hand-picked by German immunotherapy powerhouse BioNTech to house a new R&D hub, on the Cambridge Biomedical Campus, as part of a potential £1 billion 10-year investment programme in the UK, creating hundreds of jobs and forming the basis of a genomics partnership.

- Cambridge was the first ecosystem to translate the UK government strategic partnership with Flagship Pioneering, the bio-platform innovation company. Flagship announced an agreement with top life sciences organisations Cambridge University Health Partners (CUHP), and the Milner Therapeutics Institute (MTI) to collaborate to jointly advance breakthrough scientific research and technologies. The Flagship team will establish relationships with key academics and clinicians in the cluster, as well as developing collaborations with the NIHR Cambridge Biomedical Research Centre (BRC) to engage with Fellowships and clinical trials.

- GSK plc has made a five-year investment to establish the Cambridge-GSK Translational Immunology Collaboration (GC-TIC), with the University of Cambridge and Cambridge University Hospitals, to help patients with hard-to-treat kidney and respiratory diseases.

What we are actively doing and planning:

Cambridge University Health Partners is supporting the coordination of the CUHP members (two universities, three NHS Trusts) as well as the wider Cambridge life sciences and healthcare cluster, to provide co-ordinated response to engage with new and existing external strategic partnerships. A Strategic Partnerships Sub-Committee has been established under CUHP to support a streamlined approach to building new industry partnerships.

Our ask of DHSC / DBT / OLS and other stakeholders:

As the UK Government bodies engage with potential UK strategic partners, Cambridge would welcome conversations to identify where Cambridge can initiate, support or land new strategic partners. Cambridge is open for business. We would like the government to feel able to approach Cambridge University Health Partners, who actively support the whole Cambridge cluster, to help brainstorm and shape strategic partnerships. We can support by highlighting existing collaborations and provide access to researchers, clinicians or institutions, which could form part of new strategic partnerships.

ACTION 23. Establish a dedicated service to support 10-20 high-potential UK companies to successfully scale, invest and remain domiciled in the UK.

Cambridge welcomes the support for companies to successfully scale and remain in the UK. Small to medium-sized enterprises (SMEs) are the backbone of the British economy, employing over 60% of the country’s workforce. As they scale, these organisations face complex challenges in areas like technology adoption, value-chain expansion and talent acquisition, as well as appropriate access to capital. In today’s landscape, business support services are available, yet they often overlook the “gazelle” companies — those with potential for rapid expansion. These high-growth SMEs are at the frontier of their sectors, needing specialist guidance to overcome critical hurdles and unlock their full potential. The support to companies it is very linked with London Stock Exchange (LSE) listing/IPO, so the link with crowding in the right sorts of investors is key to success.

Existing Cambridge strengths and initiatives the UK can build on:

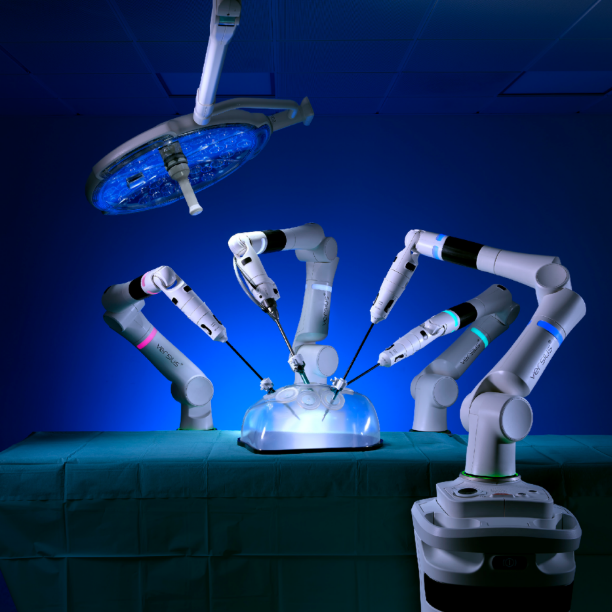

There has been a succession of companies scaling and remaining in the Cambridge region, for example – CMR Surgical, Bicycle and Cycle Pharmaceuticals (now in the scaling commercial stage in the UK). However, more needs to be done to support these rapid-growth businesses.

There are a number of locations such as the Babraham Research Campus and St Johns Innovation Centre designed to support the needs of early stage life science companies providing laboratory facilities and there exists a network of support available in the Cambridge ecosystem, for example the accelerators and incubators Accelerate@Babraham, Founders, Frameshift, Milner Therapeutics Institute, Apollo Therapeutics, One Nucleus, CPCA Growth Hub, Cambridge Network, Cambridge Enterprise, and a plethora of active venture capital companies, Cambridge Angels, Cambridge Innovation capital, Ahren. IQ, Amadeus. These organisations, networks and initiatives provide a base to build more targeted support for companies that go onto have a high growth potential.

One Nucleus Boston Bootcamp: Through our regional life science membership organisation One Nucleus, annual cohorts of early-stage life science companies embarked on an intensive programme to engage with the globally renowned Massachusetts (MA) life sciences ecosystem. This is particularly valuable for UK companies to be aware and learn from ecosystems like Boston. With its deep investor base and thriving biotech network, it remains a critical hub for accessing capital, collaborations and helping companies to accelerate their commercial growth.

Highlighted in Action 14, the Cambridge ecosystem continues to support companies by showcasing to global investors, including during Cambridge Wide Open Week and Jefferies Healthcare Conference.

What we are actively doing and planning:

To support the Cambridge companies Cambridge University Health Partners (CUHP) has, as part of its strategic Talent Pillar, developed and run a feasibility study to create a Multi-Specialist Hub that offers mentorship and fractional expertise for growth companies.

The Multi-Specialist Hub is a pilot initiative, designed to provide fractional access to experienced business leaders, industry specialists, and executive-level advisors to support high-growth companies in Cambridge. A feasibility study carefully analysed “problem statements” from six Cambridge cluster companies and crafted bespoke solutions, providing precisely tailored support to help them move to the next phase of their growth journey, demonstrating the need and viability of this model for the Cambridge cluster.

The next phase of this initiative would be to formalise the establishment of the Multi-Specialist Hub as a legal entity and to further explore, monitor and assess collaboration opportunities with existing company support networks, demand for the Hub’s services, the level of commitment from potential subscribers – companies and contributors (Fractional/Advisors/Mentors) – and initial financial sustainability.

Our ask of DHSC / DBT / OLS and other stakeholders:

The Cambridge cluster would like to offer the OLS our support in identifying the 10-20 companies and establishing a set of smart criteria for their identification. In addition, we would like to support further, by working closely with the CPCA, in identifying the real needs of companies in the region to help OLS to frame its ‘support service’.

To continue the momentum of the Multi-Specialist Hub, resource for a life sciences and tech project manager (0.4FTE) and a budget of £30,000- £50,000 is needed for the setup activities, covering:

- Legal fees for incorporation and drafting governance documents

- Administrative costs for registration and initial compliance

- Basic operational setup, such as accounting and website development

This would provide a proof of concept for a year. If successful, the model could be expanded across the UK.

system enabling less invasive surgery, developed in

Cambridge by CMR Surgical, manufactured in Ely

Pillar 3 – Driving Health Innovation and NHS Reform

The Cambridge cluster is dedicated to driving scientific and health innovation and @NHS reform across the region.

ACTION 31. Strengthen innovation metrics for medicines and MedTech through an updated and expanded Innovation Scorecard. England

It will be critical to support the NHS in becoming an effective partner in the testing and uptake of innovation, and to support a shift in the NHS to make the testing and adoption of innovation a priority. Central to this will be implementation of the key recommendations made by the Innovation Ecosystem Programme (IEP), led by Roland Sinker, Chief Executive of Cambridge University Hospitals, and the O’Shaughnessy Review into commercial clinical trials, led by Lord James O’Shaughnessy, Chair of Cambridge University Health Partners.

Existing Cambridge strengths and initiatives the UK can build on:

At a local level, Cambridge University Health Partners has piloted support for Innovation Landing Zones within our NHS trusts, as funded functions which provide the capacity and capability for innovation within their organisations, plus their links across the Cambridgeshire and Peterborough Integrated Care System.

These are aligned and mutually supported by several national schemes based around Cambridge hubs, demonstrating sustained and system-wide support:

- The NHS Clinical Entrepreneur Programme, delivered by Anglia Ruskin University, which has offered support to more than 1,300 Clinical Entrepreneurs in the eight years since its 2016 launch.

- The Cambridgeshire & Peterborough Adopting Innovation Hub, funded by the Health Foundation and launched in 2022 as one of four regional hubs dedicated to implementing and spreading proven innovations, with an emphasis on health inequality and co-production.

- An NHS InSite awarded in 2024 to Cambridgeshire and Peterborough NHS Foundation Trust, which works across the Integrated Care System to test and evaluate innovations in real-world settings prior to adoption.

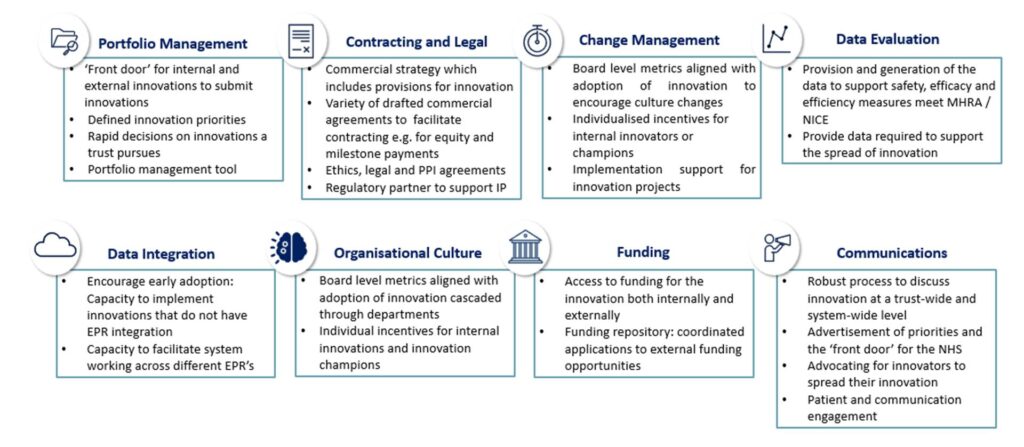

Through Cambridge University Health Partners, we have developed the key capabilities and approaches essential for the successful progress of innovation – we are working with each of our providers to put these in place:

In addition, each of our NHS providers has pledged to develop Key Performance Indicators to measure and set targets for innovation at board level, committing to:

- Shared visibility of innovation across the ICS.

- Delivery of two new innovations taken from initial approach through to trial.

- Report on the number of commercially sponsored interventional trials and the number of participants.

Our plans in this area:

Cambridge University Health Partners (CUHP) is supporting coordination of the Cambridge cluster around innovation.

Across the Integrated Care System, CUHP is sponsoring the development of an ‘innovation portal’ to improve navigation and visibility of the innovation landscape, provide clear communication of entry points to the system for external partners and signposting to resources plus support for internal innovators.

An Innovation Sub-Committee has been established under CUHP to ensure that innovation is incentivised at board level, to share best practice, address joint challenges and to develop and adopt meaningful KPIs to promote innovation initiatives and incentives.

Our ask of DHSC / DBT / OLS and other stakeholders:

We plan to build on the initial metrics which we have already adopted across our NHS providers for both medical technologies and medicines. We are keen to work with government to devise the Key Performance Indicators for the NHS Innovation Scorecard as a lead adoption site.

We would also include the number of industry partnerships established, recognising that the NHS will be a key delivery vehicle for Government ambitions in support of Actions 22 and 23.

Whilst we support the implementation of innovation metrics for providers, NHS organisations will still need support and investment to generate the capacity and capabilities to land innovations and to work with industry. The development of longer-term revenue streams for this type of work would be a critical enabler.

hospital trust to receive “outstanding”

across all five areas by the Care Quality

Commission (CQC)

ACTION 33. Establish Regional Health Innovation Zones for large scale development and implementation of innovation, for scale up across the health and care system. England

As long ago as 2011, the UK’s very first life sciences strategy talked boldly about the importance of positioning the NHS as a testbed for innovation to improve health outcomes and boost economic growth. It highlighted the need for streamlining industry collaborations and speeding-up the adoption of cutting-edge technologies.

The reality is, none of that has happened, and more than a decade later we still find ourselves with a risk-averse service and industry partners more frustrated than ever at how difficult it is to test something new in the NHS.

The Cambridge cluster is excited by the Government’s commitment to establish Regional Health Innovation Zones. With adequate resource giving the health systems the permission and flexibility they need to be more radical and forward-looking on innovation, they will support the NHS 10-year health plan and lead to rapid and scalable health improvement results.

Existing Cambridge strengths and initiatives the UK can build on:

Innovation has the power to increase NHS productivity, decrease pressure on staff, improve the nation’s health and attract billions of pounds of industry investment into the economy. Cambridgeshire and Peterborough present a compelling case to become a Regional Health Innovation Zone with a Mayoral Combined Authority embedded at the heart of the UK’s leading life sciences ecosystem.

The recent, Cambridge-led Innovation Ecosystem Programme (IEP), together with the highly evidenced and comprehensive 2023 O’Shaughnessy Review into boosting commercial clinical trials, is the blueprint for making the vision a reality. The government now has a list of predominantly zero-cost recommendations that, if implemented, will allow the NHS to finally embrace innovation.

Innovate Cambridge was launched in September 2022 to define the future of the Greater Cambridge life sciences and technology ecosystem to ensure it continues to transform the UK and the world for the better. More than 200 organisations have signed up to an Innovation Charter for Cambridge and have used this unprecedented mandate to consult with 500+ people to develop an innovation strategy.

The Cambridgeshire region is already leading Europe in discovery science. Couple that with our pioneering work implementing new NHS Innovation Landing Zones, plus our expertise and track record in inventions that have changed the world (monoclonal antibody technology, genomics, IVF) and we believe Cambridge makes an ideal place to host a Regional Health Innovation Zone. The Research intensive universities and institutes across the region (Anglia Ruskin University in Cambridge and Peterborough, the Babraham Institute, the MRC Laboratory of Molecular Biology, the University of Cambridge, the Wellcome Sanger Institute) and five NHS Trusts (Cambridge University Hospitals , Cambridgeshire and Peterborough, Cambridgeshire Community Services, North West Anglia and Royal Papworth Hospital), the region is focussed on research, innovation and making the NHS the best place in the world to test and adopt innovations. It is not a question of building up talent and capabilities, the resources and collaborations are already in place and innovating at pace.

Bringing all this together, the region also has the Integrated Care Board (ICB) ‘Head of Innovation’ post, working alongside Health Innovation East, to accelerate adoption of innovation for patient benefit.

Other key elements to create a regional Innovation Zone, in addition to the institutions and NHS Trusts listed above, include the concentration of translational and support and networking functions. These include but are not limited to the NIHR Cambridge Biomedical Research Centre, the NIHR Bioresource, the Cambridge Clinical Research Facilities, Health Innovation East, the Applied Research Collaborative, the Eastern England Secure Data Environment, the Health Data Research Service, leadership of the Clinical Entrepreneur Programme and the Cambridgeshire & Peterborough Adopting Innovation Hub.

What we are actively doing and planning:

Cambridge University Health Partners (CUHP) NHS Trusts have established or are developing Innovation Landing Zones/Insite sites (in CPFT) to help the best life science/healthcare ideas become reality.

The landing zones offer advice, signposting and mentorship to innovators and entrepreneurs, from the NHS Trust or across the region, to guide and support piloting or testing innovations in the NHS environment. CUHP organise monthly ‘Innovation Clinics’ that offer innovators examples of lived experience and personalised advice from local experts and entrepreneurs to help them stress-test ideas. Supporting ideas has already enabled us to transform healthcare in the NHS.

- Investing in Leadership for Innovation: Three NHS Trusts, Cambridgeshire and Peterborough (supporting mental health services), Cambridgeshire University Hospitals and Royal Papworth Hospital have invested in recruiting roles dedicated to supporting innovation within their organisations.

- Piloting innovation: one successful example is Cambridge cancer doctor Raj Jena, who was given a day a week for ten years to work on a new AI system with Microsoft. The result was OSAIRIS, a programme that can mark-up complex cancer scans 4.5x quicker than a human, cutting waiting times and allowing more face-to-face contact with patients

- Implementation of the pioneering non-Invasive Cancer Treatment – Histotripsy at CUH, a revolutionary, scalpel-free ultrasound treatment for liver tumours that has the potential to reduce cancer treatment times, avoid disease progression and improve cancer survival. Approved via the MHRA’s Innovative Devices Access Pathway, this treatment is now available as a 30-minute outpatient procedure.

Our asks to DHSC, DBT and OLS:

We ask that the East of England be considered a trailblazer for the proposed Regional Innovation Zones. Indeed, Cambridgeshire and Peterborough presents a compelling case with a Mayoral Combined Authority embedded at the heart of Europe’s leading life sciences cluster.

Other asks relating to innovation include:

- Support the new acute hospital needed for the region to support public health and Innovation.

- Support access to high-quality, interoperable health data to be used for research and developing innovation.

- Make ‘innovation’ part of the core business of the NHS, helping leaders make the case for spending budget on innovations to save time and money in the future, leading to improved job satisfaction for staff by cutting admin tasks and increasing patient time.

- Support NHS organisations to invest in the capacity to land innovations and work with industry, and to develop longer term revenue streams for this work.